Council retreat to Commercial in Confidence every time

- The Beagle

- Aug 19, 2017

- 3 min read

Dear Editor

I have finally received a response to my questions from council’s general manager as follows – your readers may be interested to note that the general manager considers these matters to be ‘confidential’ to the public:

1.Prior to negotiating the purchase of the Batemans Bay Bowling Club on behalf of the residents of Eurobodalla Shire, did you obtain a sworn valuation? If so, please provide copy.

Response: Council has secured valuations. These are commercial in confidence and cannot be released. Beagle readers, we know that Council bought the land for $2.7 million.

We also know from the Catalina Country Club Ltd.2015 - 2016 Annual Report that the land is burdened by a riparian corridor was highlighted as a contract killer. This corridor restricts development within 40 metres of the high water line and resulted in a 30 percent reduction in available land and that the Catalina Country Club was in negotiations with another possible purchaser. The annual report very clearly states "During these negotiations a riparian corridor was highlighted as a contract killer... The deal fell through...." We also know that the land is subject to the same potential inundations as Surfside and must therefore have the same building constraints applied. The land is adjacent to a creek and it has to go hand in hand that if Surfside has a rule then the same rule applies on the other side of the Clyde. We also know from experience that it will be very difficult to set solid foundations as they discovered in Stocklands Mall when it was being constructed. The Mayor has been saying publically that the land is now worth considerably more than they paid however the figures she quotes are in conflict with the commercial land values of the adjacent CBD. Question 2. What is the name of the financial institution that financed the loan to purchase

the Bowling Club?

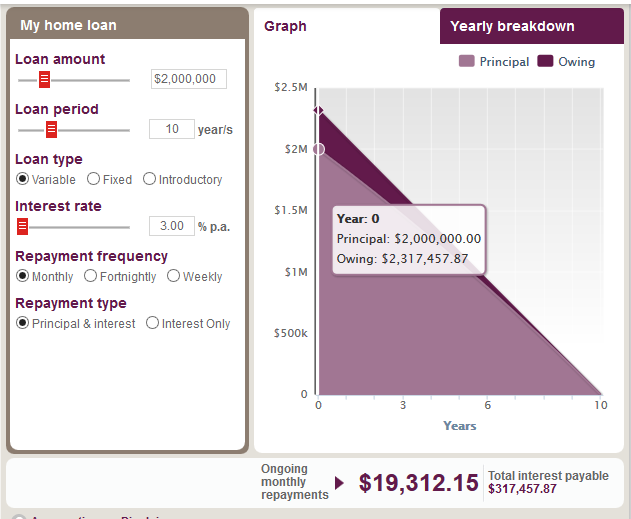

Council Response: Loan funds for the Batemans Bay Bowling Club were from NSW Treasury Corporation (TCorp). Beagle readers, from their website we learn that TCorp offers loan facilities to New South Wales local councils seeking funding for projects which make up part of their annual expenditure programmes. Loan facilities, at competitive rates, are available to local councils who are deemed Fit for the Future and satisfy TCorp’s credit criteria. The figures below are from a bank loan calculator. Borrow $2 million over 10 years and pay approx 3% and it will cost $317,000 in interest.

Question 3. What is the current rate of interest on this loan?

Council Response: The terms and duration of the loan are Commercial in Confidence as verified by TCorp. Beagle readers might be interested to know that Council paid $3.3 million in interest on loans in 2015/2016.

Question 4. What is the current balance of this loan?

Council Response:The terms and duration of the loan are Commercial in Confidence as verified by TCorp. Well, the current balance might be Commercial in Confidence but at some point in time this is all going to have to come out in Council's Financial Statements. I have now asked Council on what basis they claim that the information I seek to be ‘commercial in confidence’ when it is the community’s money, the community’s loan and the community’s assets. Aren't Council merely managing ‘our’ money and assets ? Coral Anderson